China's Economic Rebound Remains Elusive, Impacting Market Outlook and Growth Prospects

China’s exports to the EU and the US declined after central banks and the Federal Reserve raised interest rates in March. The demand for products from China in these markets was already low. Despite that, however, China’s exports did see a rebound in Q1 2023. Exports in March rose 14.8% from a year ago after months of declines. The General Administration of Customs of China reported that exports went up 0.5% over the same period in 2022 to $821.8 billion in the first three months of the year.

This could be attributed to the fact that factories are now running at full capacity and working on fulfilling accumulated orders. China’s COVID-19 outbreak had depleted the inventories until the beginning of 2023. But now, the country’s international trade is displaying resilience.

The Shanghai Containerized Freight Index rose for three consecutive weeks in April. That had not happened since June 2022.

This was influenced by the increase in shipping rates to the US East Coast from Asia by around $137 per 40ft container in April when compared with the previous weeks. On the other hand, spot rates on the US routes fell by around 80% of their peak levels last year. In the face of the current geopolitical friction between China and the US, it remains to be seen if the stability in China will be challenged anytime soon.

China – Russia trade on the rise

China is the world’s biggest energy consumer and demand for domestic fuel rebounded once the Covid restrictions were lifted. Chinese refiners took advantage of the cheap prices of fuel imported from Russia. Not just refiners, the country has increased other purchases from Russia after the US and EU cut their Russian imports. No wonder then that imports from Russia, primarily oil and gas, reportedly rose by 40.5% in a year. China’s trade deficit with Russia has lessened by 50% to $2 billion and exports to Russia have more than doubled to $9 billion over a year.

On the Container xChange platform, China to Russia has been the most popular route this year and the average pickup (PU) charge for leasing a container in the route was $905. For example, the average PU rate from Ningbo to Moscow was $985 and the same from Shanghai was $830. After Russia, the popular destinations from China included North America and North Europe.

Intra-Asia trade continues to show resilience

“Not just with Russia, intra-Asia trade has significantly outperformed Asia-Europe and Asia-US trade as well. Especially after a decline in consumer confidence in the EU and North American consumer markets, overstocked retail inventories, and the collapse of ocean freight rates last year. The intra-Asian economy, in comparison, has proven to be far more resilient.” commented Christian Roeloffs, cofounder and CEO, Container xChange. According to the United Nations Conference on Trade and Development (UNTCAD), East Asia was the only region with a positive quarter-to-quarter trade growth rate in Q3 2022.

Within that context, a rebound in demand from China will benefit both the global suppliers and the country’s Asian neighbours. The China-Southeast Asia trade is emerging as a strong economic partnership this year. China’s largest trade partner is the Association of Southeast Asian Nations (ASEAN) and shipments to these nations have grown by 35.43% year-over-year. This dramatic increase underlines China aiming to strengthen trade ties in these markets.

“Despite the global supply chain wanting to reduce dependency on China, the country’s major seaports are opening new container shipping routes this year to expand capacity, enhance foreign trade and increase market share. For example, in Q1 2023, the Shandong Province launched 13 new shipping routes in forging boutique lines bound for European and American countries.” Roeloffs added.

“On Container xChange platform, ports in China were the most popular trading locations in the month of May. Vietnam, Indonesia and Singapore followed suit.”

The BRICS alliance of Brazil, Russia, India, China, and South Africa accounts for 17% of global trade and one-third of global GDP. Therefore, it plays a critical role in ensuring global financial stability. In the last few months, the Global South has been increasingly interested in BRICS as a way of moving away of the ‘western financial system’, according to data released by the Islamic Republic’s Customs Administration.

For instance, non-oil trade between Iran and the BRICS alliance has grown by 14% in one year and is estimated at $38.43 billion 2022-23. China is Iran’s main trade partner in the BRICS alliance, India second followed by Russia, Brazil and South Africa. Central Asian countries have recorded an increase of imports from China by 55% in March 2023, when compared to this time last year. This is even bigger than the imports from China to other Southeast Asian countries.

Labour layoffs

It is unlikely that Chinese suppliers will lower the prices of the products or invest more in operations. Consequently, this means that to lower their cost of production, they will look at reducing cost of labour. Small and medium businesses in China’s manufacturing sector have already noted both factory closures and layoffs to tackle the economic situation. But the picture is grim for the giants as well. Tesla had slashed prices of Tesla EVs in China last year. This year, Ford offered discounts in China too, but the company is now reportedly cutting its operational costs by contemplating layoffs. It’s ironic as policymakers in China are targeting 12 million new jobs in China in 2023, a 1 million rise than in 2022.

Stronger focus on the Belt and Road Initiative

Last year, the Qingdao port in eastern China opened 38 new routes. These routes were mostly along the Belt and Road Initiative route and catered to the emerging markets such as Southeast Asia, Latin America and Middle East as opposed to the US or North Europe. The port handled almost 7 million 20-foot TEUs in Q1, recording a 16.6% increase since Q1 2022.

Interestingly, the Shanghai port that exports primarily to America and Europe recorded a 6.4% decline in Q1. According to the General Administration of Customs of China, the country’s exports of intermediate goods to nations of the Belt and Road initiative rose 18.2% in the first quarter from the year earlier to $158 billion, representing more than half of all exports to these countries. As the demand for Chinese exports moves towards new regions, prices for container shipping to these regions have gone up too. At the beginning of May, the average price of a 20-foot container being shipped from Shanghai to the Persian Gulf were 50% above this year's lows, according to the Shanghai Shipping Exchange. And the average prices to eastern South America were up more than 80%.

Average container prices stabilise in China

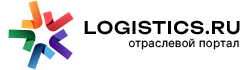

The average prices for 20 ft brand new containers have been declining across various ports in China. A long-term view of these prices gives us a good knowledge of how the demand for containers declined in China since September 2021. Below is a chart that studies the average prices for 20 feet of dry cargo brand-new containers across key ports in China. We see that these average prices were somewhere around $4047 in Shanghai in October 2021. From there, we see a dip of 43% to $2333 in May 2023.

Chart 1: Average price 20 ft DC Cargo-worthy in Shanghai

We see a similar trend of long-term decline across other ports in China like Qingdao, Shenzhen, Tianjin and Guangzhou. However, if we look at the trend of average container prices in China in the past 6 months, then the graph remains flat for most of the ports in China. For some ports like Quingdao, the average prices for 20 ft DC brand new containers increased from $2264 in week 17 to $2486 in week 18 in 2023.

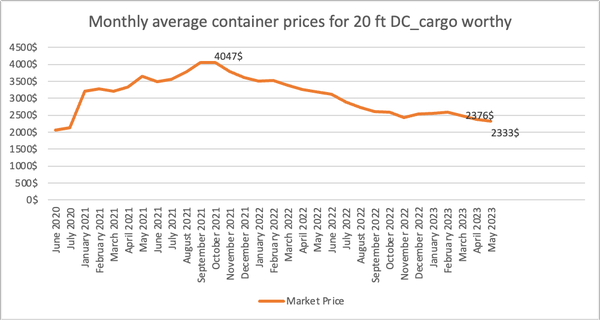

Here is a comparison of the price volatility across different regions globally

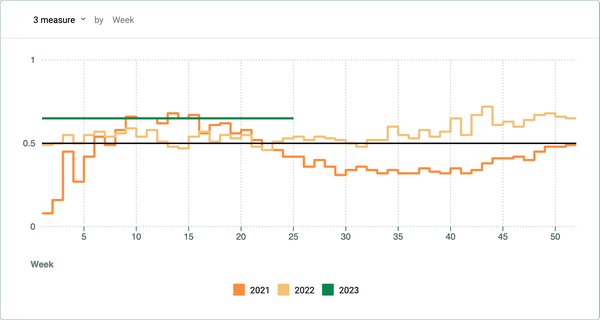

Chart 2: Price volatility tracker-Container xChange Insights

If you see in Chart 2, the container prices by region, we notice that the prices are not sliding significantly, in fact, they are changing very marginally, almost negligible across all the regions. This shows that the prices are not further sliding and this in turn also could potentially mean that the volatility in terms of container prices is significantly reduced globally now. However, we do understand through the May survey we conducted and reported in our May edition of the global Forecaster that there could be larger impacts that could disrupt the shipping industry.

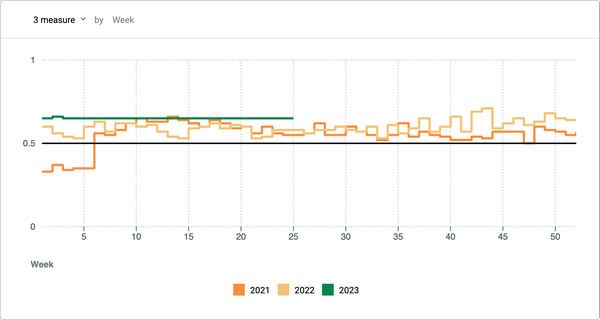

Container availability index (CAx) shows more inbound containers at ports in China

Exports to imports ratio stagnate for China. While exports to Europe and to the US declined, exports to Russia stayed strong. Peak season demand yet to kick off in Shanghai. Our Container availability index shows that the inbound containers in China are in majority if compared to outbound containers across key ports. A higher consistent value of CAx is determined by higher inbounds as compared to lower outbounds.

Chart 3: CAx Shanghai

Chart 4: CAx Ningbo