For the first time this year in May, the average container prices globally have soared month on month at an average of 5.4% (from $2207 to $2330) for the 20 ft DC and by 15% (from $3800 to $4410) for 40 ft HC. However, the average container prices and the leasing rates continue to decline in China even as the country reopens after massive two months of lockdowns.

The insights are a part of the monthly container logistics report titled ‘Where are all the containers’ published by Container xChange, a technology infrastructure provider for container logistics players.

“We expect a surge of containers onto the transpacific, leading to higher utilization of vessels on this route. We could see a surge in spot rates especially with the upcoming peak season.” said Christian Roeloffs, cofounder and CEO, Container xChange.

“Not only Shanghai was in lockdown, right now Beijing and its biggest harbour Tianjin is still in lockdown. All cities are so interlinked that it influences the whole of China. For instance, Shanghai is the main hub to produce car parts and Shenzhen is for assembly. Since no parts are dispatched to Shenzhen, nothing can get assembled and thus exports out of Shenzhen also experience slow down.”

“If we look at the west, there is major congestion in Los Angeles and Houston. It has become particularly challenging to find open depots and moving units in Shanghai. Depots in Rotterdam are also quite full, followed by Hamburg (but less flagrant than Rotterdam).”

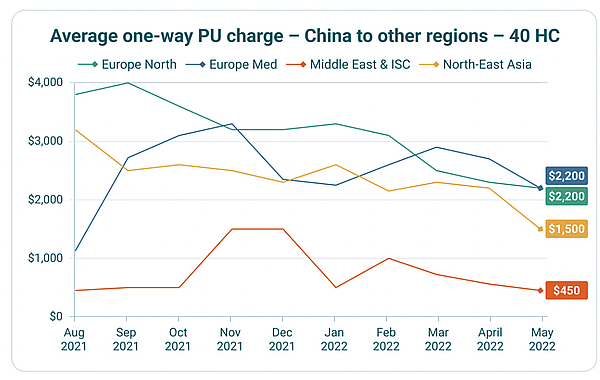

“We saw a decrease in pick up charges in the past months in China because there was a lack of demand for containers there. In the short term, we expect a spike in container prices because the demand (the pent-up demand) for containers will shoot up especially because we have the peak season coming up.

“However, in the mid to long term, we do expect container prices to go down, containers availability to go up and container turnaround times to normalise because we expect the supply chain disruptions to ease.” said Roeloffs.

Impact of decline in consumer demand for goods on shipping?

“A metric cited by Goldman Sachs shows goods consumption about 5 percent higher from before the pandemic, down from a peak gap of 15 percent. However, the demand side was never really the massive driver of the price increase on the rates. Owing to the supply chain shocks, the containers just took much longer than before and hence there was just not enough supply of containers which coupled with a little bit of an increase in demand and led to this situation that we faced. So, I don't think that slight reduction in demand will be a massive driver of market changes but of course, it will contribute.”

“To sum up, I think the consumer demand (and eventually presumable unprecedented container demand) wasn't the biggest driver of the destabilization of market, but it was rather a sort of supply shock and that there were just not enough boxes to go around and because they took longer to move from A to B.” said Roeloffs

Emergence of new trade routes

We do foresee a gradual increase in demand for smaller vessels meant for smaller trade networks. This is because there will be an uptick in more complex networks with more stops and longer turnaround times. Supply chain routes and transhipment lanes are being reimagined to build resilience and to lower the reliance on bigger trade blocks. So, in a way, diversification of trade blocks to diversify the supply chain risks.

For instance, this could mean more stops in Southeast Asia, then all of this goes into Singapore or Hong Kong in a major hub and then re-export to across, for example, the Pacific. That again, not only increases intraregional traffic, but it also increases the importance of these transit hubs. And then lastly, I think it will increase the importance of smaller players in the market.