Jones Lang LaSalle preliminary numbers show direct investment volumes reached US$114 billion in Q2; H1 2013 up 11 percent compared to first half of 2012.

London, Chicago, Singapore, 8 July, 2013

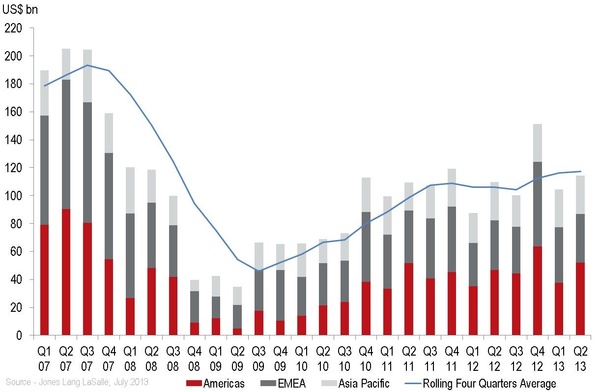

Global commercial real estate markets continued to rally in 2013 with transaction volumes in H1 2013 up 11 percent on H1 2012, according to Jones Lang LaSalle capital markets research, which spans 60 countries and over 130 cities worldwide. Direct commercial real estate investment volumes in Q2 2013 reached US$114 billion globally, up four percent on Q2 2012 and up nine percent on Q1 2013.

Continued strong growth in Q2 2013 has kept global volumes above US$100 billion for five consecutive quarters, evidencing increasing investor confidence in commercial real estate, despite volatility in equity and bond markets. Other highlights include:

- The Americas saw a 39 percent rise in transaction volumes in Q2 compared to Q1 2013, reaching US$52 billion (up 11 percent year-on-year); H1 totalled US$90 billion, equating to a nine percent increase over the same time last year. Quarterly volumes in Mexico and Canada rose significantly to keep pace with the continued acceleration in the U.S. market which grew by 19 percent year on year in Q2 2013.

- Asia Pacific and EMEA both recorded strong growth over the half year with 11 percent and 12 percent year-on-year increases in volumes respectively. Quarterly volumes in Asia Pacific remained flat both quarter on quarter and year on year, quarterly volumes in EMEA were flat year on year but down 13 percent quarter on quarter following a buoyant start to 2013.

- The largest markets globally continued to see growth over the first half of the year with Japan (+50 percent), Australia (+10 percent), UK (+4 percent), Germany (+43 percent), France (+6 percent) all recording half year increases compared to H1 2012. Only China (-20 percent) saw transaction volumes fall in the first half, however a stronger performance is expected in the second half of the year as deals already in progress complete.

- Jones Lang LaSalle’s forecasts for the remainder of 2013 remain at between US$450-500 billion. With global volumes up 11 percent on this time last year and the second half of the year traditionally busier than the first, the global investment market is on track to surpass last year’s volumes.

Arthur de Haast, Lead Director, International Capital Group at Jones Lang LaSalle said: “Over the past two to three years, we have predicted that more capital would be allocated to direct investment in core property assets; this is now materialising. Institutional, private equity and high net worth individual investors are now consistently bidding on opportunities around the world. In addition to this, investors are starting to diversify their portfolios, both in terms of risk and geography, looking for more value-added and secondary opportunities; a trend we expect to continue over the short to medium term.”

David Green-Morgan, Global Capital Markets Research Director at Jones Lang LaSalle said, “The volatility we have seen in equity and bond markets over the last quarter has further added to the attraction of commercial property as an asset class. So far, the rising cost of global real estate debt has had little effect on transaction volumes with most deals funded on modest loan to value ratios. Unless there is a substantial rise in the cost of debt, it is only likely to have a marginal impact on transactional volumes for the remainder of 2013.”

Regional transaction volumes

What is Global Capital Flows?

Jones Lang LaSalle’s Global Capital Flows analysis provides a set of data designed to help investors understand how commercial real estate capital in the aggregate is moving around the world. The data does not reflect Jones Lang LaSalle’s own business and is not indicative of Jones Lang LaSalle’s overall performance or the portion of the overall market in which Jones Lang LaSalle participates. The findings are released quarterly, first in the transaction volume analysis represented in this release, and secondly in a broader quarterly report which will be issued in the following weeks. All of the current Global Capital Flows data can be found in an interactive website which also acts as a portal for media and clients to access Jones Lang LaSalle’s global capital markets research. Bookmark this site for the most up to date global real estate data: http://www.joneslanglasallesites.com/gcf

About Jones Lang LaSalle

Jones Lang LaSalle (NYSE:JLL) is a professional services and investment management firm offering specialized real estate services to clients seeking increased value by owning, occupying and investing in real estate. With annual revenue of $3.9 billion, Jones Lang LaSalle operates in 70 countries from more than 1,000 locations worldwide. On behalf of its clients, the firm provides management and real estate outsourcing services to a property portfolio of 242 million square meters and completed $63 billion in sales, acquisitions and finance transactions in 2012. Its investment management business, LaSalle Investment Management, has $47.7 billion of real estate assets under management.

In Russia and CIS Jones Lang LaSalle have offices in Moscow, St. Petersburg, Kiev and Aktau. Jones Lang LaSalle, Russia was voted Consultant of the Year in 2004, 2006, 2007, 2008, 2009, 2010, 2011, 2012 and 2013 at the Commercial Real Estate Awards, Moscow and Consultant of the Year at the Commercial Real Estate Awards 2009, St. Petersburg.

For further information, please visit www.jll.ru

Contact: Rachel Smylie, PR Natalia Kopeychenko, Head of Public Relations

Company: Jones Lang LaSalle Jones Lang LaSalle, Russia & CIS

Tel: +65 6494 3771 +7 (495) 737-80-00 #335,

+7 (965) 244-43-75

E-mail: Rachel.smylie@ap.jll.com

Natalia.Kopeychenko@eu.jll.com