A larger share of freight forwarders and supply chain professionals this year in 2023 are expecting disruptions owing to COVID outbreaks in China and the Chinese New Year factory closures as compared to the last year (2022).

“We are looking at three different Chinese Years in 2020, 2021 and 2022. It’s not what we’ve been accustomed to in the prior years when there was demand leading up to the Chinese New Year. There is a lot of inventory with retailers and manufacturers. Inflation and fear of recession continue to impact demand. And therefore, the spot rates have started to fall off the cliff. There are a lot of unknowns and preparing with better data, information and visibility into the supply chain is the way to navigate through these unforeseen times.” said Cathy Morrow Roberson, Founder and President of Logistics Trends & Insights LLC during a webinar organised by Container xChange on the Chinese New Year analysis and predictions.

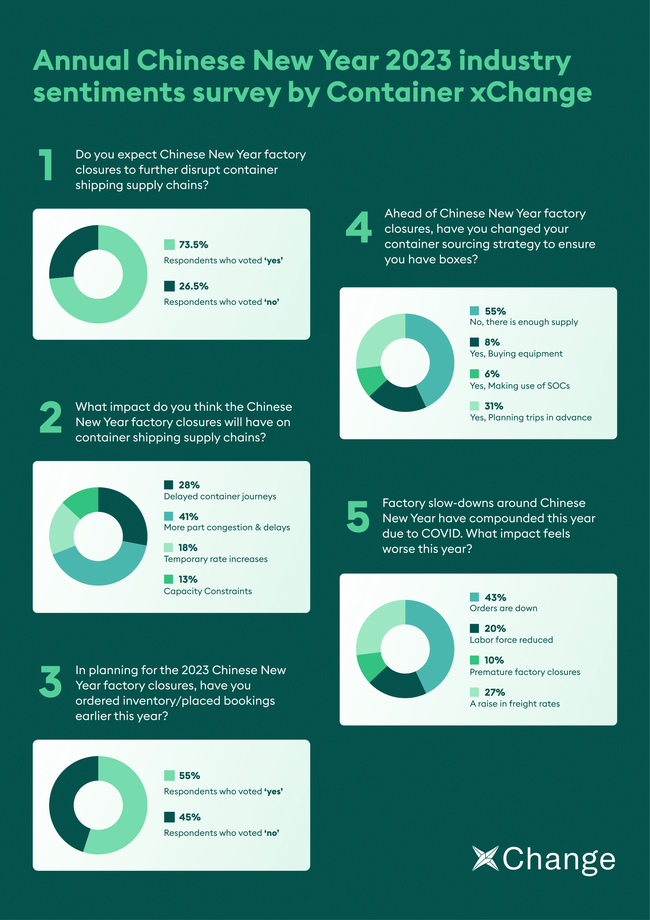

The annual Chinese New Year survey by Container xChange witnessed some 2300 respondents from the supply chain industry sharing their opinions and views about how they view Chinese New Year and COVID outbreaks in China have an impact on global supply chains.

As compared to some 66% in 2022, there was an increase in the percentage (73%) of supply chain professionals expecting Chinese New Year to further disrupt the shipping industry this year.This comes in contrast to industry reports where a lot of analysis talks about lessening the impact of disruptions in China on the global supply chains. Out of the 73% saying that they do foresee an impact, 65% were freight forwarders and the rest were supply chain professionals in general.

“Usually, we expect a cargo rush in January and February but this year, the Chinese New Year is earlier. The situation will have a significant impact on the domestic supply chain from January 15 to February 6, 2023. In my opinion, this time is difficult for businesses. I think companies can prepare better by controlling costs, better forecasting, and efficient information flow. This is where technology can help greatly.” commented Mr. Sun Director / General Manager, CNTRANS in the webinar.

When asked in the survey, ‘what impact will be the most prominent in the coming weeks’, most agreed that there will be ‘an increase in port congestions and delays’ and ‘delayed container journeys’ soon after China reopens. Last year, most industry professionals feared capacity issues and higher rates as the Chinese New Year aftermath. One respondent elaborated, “I think an ‘increase in port congestions and delays’ and ‘delayed container journeys’ will be the possible result as it makes sense to me that once they all ship out again that means more ships leaving closer to one another for the same destinations which may cause backups for a short time.”

“There are added, and new complexities ahead coupled with Chinese New Year where at one end we see China coping with the Covid infections, and on the other end we see a continued dip in demand. We cannot see Chinese New Year in isolation but in combination with all these challenges. The biggest concern is the reduced production and port capacity due to the infections in China. Also, the rates are low, capacity management is still a top priority for carriers and blank sailings are prominent. Amidst this, in the coming weeks, we foresee prolonged factory closures and bearish market conditions.” Christian Roeloffs, cofounder and CEO, of Container xChange, an online container logistics platform that offers an ecosystem for booking and managing of shipping containers.

We also asked how the industry is planning for the closures. We asked - “In planning for the 2023 Chinese New Year factory closures, have you ordered inventory/placed bookings earlier this year?”

Last year, in the year 2022, 59% said ‘yes’ and this year, 55% said yes. While the majority planned advance bookings, there is a drop of 4%. Another change we noticed this year was, while 65% of international freight forwarders said they expect Chinese New Year closures to impact supply chains, only 47% have made advance plans to deal with the same. One possible cause of the dip in preparing in advance could be still high inventory levels—and the market being bearish in general, as demand continues to fall and transportation capacity supply increases.

Further, we asked ‘Ahead of Chinese New Year factory closures, have you changed your container sourcing strategy to ensure you have boxes?’ Last year in 2022, the majority said nothing specific and this year too, the majority responded by saying nothing specific, only this year, highlighting that there is enough supply.