Excess containers stranded across Europe are causing congestion bottlenecks and space shortages at ports, warehouses, and storage yards, according to the March edition of the Europe Container Market Forecaster, published by Container xChange.

The online logistics company estimates that container overcapacity currently amounts to between three and five million TEUs (Twenty-foot Equivalent Unit). As well as causing storage shortages, the excess of containers is now putting substantial downward pressure on box prices and leasing rates across the continent.

“The critical Asia-Europe container shipping lane has seen demand tail off rapidly since the summer of 2022 which has been reflected in sharp falls in container shipping spot freight rates,” said Christian Roeloffs, CEO & Co-Founder, Container xChange.

“This is prompting carriers to cut services or cascade capacity on to regional trades. The problem is that this is leaving empties stranded across Europe instead of being sent back to Asia and other origin markets to be loaded with more exports.

“When export demand picks up once more, this huge pile-up of boxes will gradually be whittled down with most returning to Asia. But strike action during March at the port of Hamburg in Germany and at various container terminals in France will slow that process.”

Ports swamped by empties

Excess containers are evident at key European hub ports monitored by Container xChange’s Container Availability Index (CAx). Readings at the ports of Hamburg, Rotterdam, and Antwerp were all above 0.8 in March. This means that a major excess of containers has built up: an index of 0.5 describes a balanced market, below 0.5 represents a shortage of containers, and above 0.5 represents excess containers.

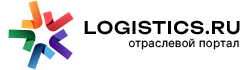

Container xChange is also seeing a relentless drop in container prices and leasing rates on its European marketplace due to excess supply. For example, average container prices for 40 ft high cube, brand new containers have been consistently falling in recent months across Europe. During week 11 (13-19 March 2023) prices dropped to $2832 per unit in Hamburg, to $3050 in Rotterdam, and to $2739 in Antwerp (see graph A below).

Graph A: Container prices Chart_40 ft HC_Brand New

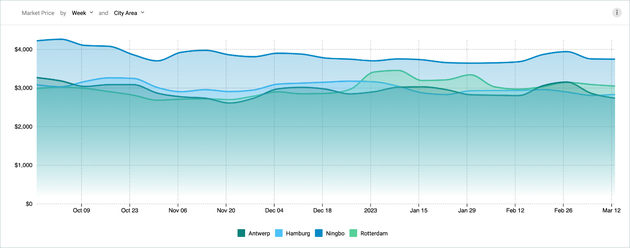

Average container prices in Europe are now considerably lower than in either China or the US (see graph B Below)

Graph B: 6 months view of average container prices_40 ft HC_brand new_Europe, China, and the US

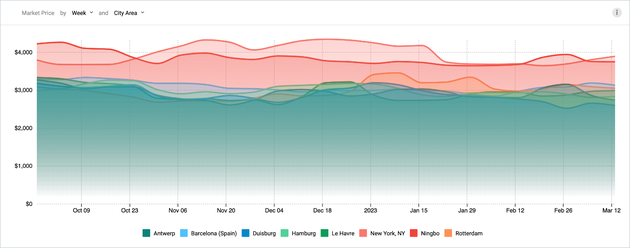

Moreover, average leasing rates from Ningbo to Rotterdam for a 40 ft High Cube container have dropped from $528 in week 9 (27 February – 9 March 2023) to $446 in week 11, a drop of 15% in two weeks (see graph C).

Graph C: Average leasing rates from Ningbo to Rotterdam_40 ft High Cube

One of Container xChange’s marketplace customers reported: “Liners are now increasingly selling off second hand units into the market at prices below what the leasing companies are requesting in their resale divisions. Most of the second-hand equipment should now be the liner equipment. This is also a sign that depot congestion is now a real issue and liners are aware of this and have started to sell off inventory.”

Economic headwinds

Global oversupply of boxes and low demand for cargo due to economic headwinds are the main drivers of the current excess of boxes across Europe. According to Eurostat, in seasonally adjusted terms the Eurozone's trade deficit on goods fell from -€13.4bn for December 2022 to -€11.4 in January 2023. Imports dropped by 1.8% to €252.9bn, a fifth consecutive monthly fall.

More positively, the February S&P Global Eurozone Composite PMI (Purchasing Managers’ Index) reported that the Eurozone economy expanded at its strongest pace since June 2022. Business confidence also rose to a 12-month high.

The positives were offset by euro area manufacturers again recording a drop in demand for their goods, although production volumes broadly stabilised in February, ending an eight-month sequence of contracting output.

Banking crisis dark clouds

However, European consumer and industry sentiment has been further knocked in March by the banking sector crisis which has resulted in major stock market losses.

“Despite the banking sector’s troubles most evident in the plights of Silicon Valley Bank, Signature Bank and Credit Suisse, such is the concern of central banks with inflation that we still saw the US Federal Reserve push up interest rates by a quarter-point on 22 March,” said Roeloffs.

“What is clear from that decision is that central banks face tough calls over interest rates in the current economic environment, which creates uncertainty for investors who understandably are taking a ‘wait and see’ approach. Less investment, especially in capital goods, means less demand for transportation and lower GDP growth.

“If central banks continue to increase rates, this will put further pressure on lower quality borrowers. And we know that there are quite a few such borrowers in the transportation and logistics industry.

“So, a lot of companies will have trouble financing themselves in an environment where already revenues are under pressure through decreased rates. Their costs are increasing through inflation which means higher OpEx and margins under more pressure. And if they now face financing issues, this could lead to serious issues across global supply chains.”

To get complete visibility into container data and analysis, subscribe to our data tool ‘Insights’ here - http://bit.ly/3TysMrT