Asia's maritime and supply chain industry is on a tumultuous ride, experiencing significant disruptions in trade patterns resulting in container prices dipping, according to the April Asia container market forecaster published by Container xChange, an online container logistics company that provides a marketplace, an operating infrastructure, and a layer of services like payments to container logistics companies globally.

Container oversupply risk looms over China with empty containers at ports

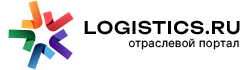

The year-on-year comparison of the Container Availability Index (CAx) in Shanghai presents some interesting insights into the problem of excess containers at the ports in China. Traditionally, the CAx values in Shanghai during Q1 have been lower than the 0.5 balance due to a higher number of outbound containers compared to inbound containers.

However, this year, the trend is just the opposite with a CAx value over the 0.6 threshold. The current trend is attributed to the drop in exports during Q1, owing to reduced demand post the peak season quarter (October- December) and the Chinese New Year shutdowns.

Consequently, the number of containers at ports is usually lower during the Q1 of the last two years. However, the situation this year is different. With a demand deficit and a higher number of containers lying idle at the ports, there is a significant rise in inbound containers in China as observed in the Q1 of 2023. This shift in the trend is reflected in the CAx graph below.

Since the beginning of week 37 (September) in 2022, the Container Availability Index (CAx) has consistently remained higher than in the previous two years. This indicates an increase in inbound containers at the port of Shanghai since September and a continued upward trend. The trend is also observed in Yantian and Tianjin ports in China.

Our research and interviews with Chinese customers reveal that the post-Lunar New Year recovery in the industry has only recently started and is below the normal expectations for this time of year. According to Descartes, US imports have declined by 16.2% from January, 25% year on year, and 0.3% compared to pre-COVID February 2019.

The Container Availability Index measures the ratio of inbound to outbound containers port-wise and a reading above 0.5 suggest more inbound than outbound containers at the ports. It suggests that ports in China currently have a higher CAx value than in 2019, 2020, 2021, and 2022, indicating a significant container surplus in China.

A higher CAx index rating means that there are more inbound containers than outbound containers. Thus, if China's outbound containers are low, it suggests that the main import countries have not been importing goods from China as usual. This trend is apparent in the industry as well.

62% slump in average container prices* Y-O-Y in China in March

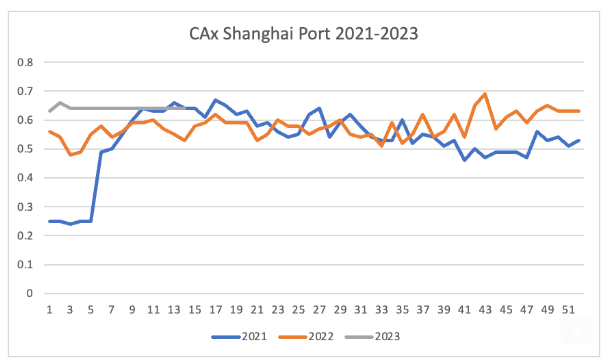

According to the analysis by Container xChange, we compare the container prices between March of this year and the same period last year, there has been an average fall of 62% in prices across China. The table below provides a detailed breakdown of the decline in prices at different ports in China.

It is noteworthy that this quarter (January to March) has been relatively more stable compared to the overall price fluctuations throughout the year.

|

Average container price development – North-East Asia

|

||||

|

Port

|

Delta to last month

|

Delta to 3m ago

|

Delta to 6m ago

|

Delta to 12m ago

|

|

Shanghai

|

6,00%

|

-14,00%

|

-36,10%

|

-62,30%

|

|

Qingdao

|

3,10% |

-1,00% |

-24,70% |

-58,60%

|

|

Ningbo

|

9,50%

|

1,70%

|

-26,20%

|

-56,60%

|

|

Tianjin

|

-0,50%

|

-7,30%

|

-28,00%

|

-54,70%

|

|

Xiamen

|

6,40%

|

-1,50%

|

-26,40%

|

-54,30%

|

|

Shenzhen

|

-9,70%

|

-1,80%

|

-32,50%

|

-60,20%

|

|

Guangzhou

|

11,20%

|

-1,90%

|

-19,00%

|

-56,00%

|

|

Dalian

|

-9,60%

|

-25,50%

|

-37,10%

|

-61,10%

|

*Average prices for containers are the prices at which containers are available to buy at these port locations.

It is evident that there has been a decline in average container prices in China since the past one year. However, the graph below indicates that the prices have remained relatively stable during the first quarter of 2023.

This observation suggests that if there is no further decrease in prices, it is possible that the container prices have already hit the bottom and are not expected to fall any further.

Intra-Asia Trade could give a push to China’s trade figures

On one hand, concerns are being raised due to the shifts in supply-chain and weakened global demand, as companies are diversifying their trade and increasingly sourcing goods from Southeast Asia. On the other, China's export numbers for March have exceeded expectations, with a significant increase of 14.8% in US dollar terms from the previous year, as reported by China government data.

The unexpected rise in exports can be attributed to improved demand from many Asian countries and Europe, as well as the resumption of production in China's factories. This is a positive glide considering the container pileup on China ports in the beginning of 2023.

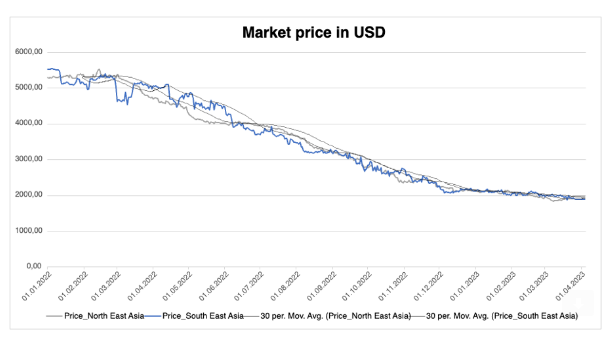

The uptick in shipments to South-East Asian nations is evidenced by sliding pickup charges on the Intra-Asia trade lane. Average pickup charges dropped by 85% since January 2023.

“The shipping industry is on the verge of completing its lap in terms of container prices bottoming out, excessive inventory, empty containers and everything in between. Once it's through with its rep, the demand will crop back up. The alluring box rates present for traders offer a ray of hope for the growth of container demand.

As the spot rates on significant container trade lanes settle down to levels like those before the pandemic, the trend of de-containerization that prevailed from 2020 to 2022 is now reversing. The container freight rates reached record heights during the peak of the coronavirus pandemic, which resulted in cargo overflowing from containers into minor bulk vessels.”, said Christian Roeloffs, cofounder and CEO, of Container xChange.

However, we cannot compare it to the demand that existed until 2021, as there is still a surplus of inventory that has not been exhausted yet. China has already initiated the process of diversification, although it is still too early to see any visible trade patterns. However, we have noticed a rise in intra-Asia trade. As a result, capacity needs to be adjusted to regions with more stable rate levels and demand to ensure more resilient supply chains in the future. This relocation strategy will decrease reliance on one production and supply chain hub and move towards a smaller and more diverse trading pattern.

The Asia-Europe container shipping lane, which is critical, has experienced a rapid decrease in demand since the summer of 2022, resulting in a sharp decline in container shipping spot freight rates. Carriers have responded by cutting services or cascading capacity to regional trades. However, this has left many empty containers stranded across Europe instead of being returned to Asia and other origin markets for loading with more exports. This accumulation of boxes will gradually decrease when export demand rises again, with the majority being returned to Asia.

China's port investments give it an edge in global trade

“China's expertise in developing world-class port infrastructure that can be an asset to strengthen global trade ties and create opportunities for collaboration, despite potential challenges for Western countries to compete in this domain.

While US and European companies are signalling their intent to shift manufacturing to India and other countries in Southeast Asia, the lack of port infrastructure in these regions remains a major obstacle.”, said Christian Roeloffs, cofounder and CEO, of Container xChange as he commented upon the current state of the container shipping in Asia.

The lack of harbours able to accommodate large ships in other Asian countries means that investment is essential to handle the mega-container ships that drive world trade. Therefore, it will take a great deal of investment from other Asian emerging markets to catch up with China, and it generally takes port operators up to five years to build a new terminal.

The data from research group Drewry reveals that the rest of Asia needs significant investment to match the capacity of Chinese harbours, which have become essential for transporting goods from east to West.

China's investment of at least $40 billion between 2016 and 2021 in coastal port infrastructure has allowed the country to handle the equivalent of 275 million 20ft containers at its ports last year, up to 80% more than the amount processed annually by all countries in Southeast Asia combined, according to figures from data group Dynamar and the UN.

In contrast, the rest of Asia has only 31 port terminals capable of handling the largest ships. Large vessels make up about two-thirds of the shipping capacity for services between East Asia and Europe, according to data provider MDS Transmodal.