Europe’s economic rebound is mixed as the service sector bounce back is the biggest since 2009 while the manufacturing sector witnessed a decline in orders for goods. The economy is expecting a modest recovery which is a very encouraging sign for the supply chains in the longer term.

The industry sense is that the freight rates and the container prices have bottomed out globally. The industry surveys conducted by S&P Global indicate a subdued economic rebound. The eurozone’s annual rate of inflation stood at 6.9% in March.

Clearly, the ocean market has not deteriorated further but still a far away from normal in Europe. Strikes in France and Hamburg during March, the Easter holidays in early April and the persistent inflationary pressures, have caused service closures and limited labour availability in this market but we do not expect further disruptions in the foreseeable future for carriers and freight forwarders.

Depots still overwhelmed

“The problem of overloaded depots persists in Europe throughout. There are more containers coming back to the depots as compared to the number of containers going out of depots. We see lower freight rates and heavy price competition, especially for small freight forwarding companies. The bigger freight forwarders are providing rates below market prices to push competition out towards consolidation.” quoted a customer of Container xChange.

“The China to EU rates is as low as $700. There is an overall reduced demand for goods in Europe, and we witness a slowdown in movement of volumes. On the Europe to China route, freight rates are as low as $91 dollars. Carriers only give 7 days of ‘free days’ for container storage and then need to pay high Demurrage and detention charges for another 7 days if they need to use containers for longer.” he added.

The smaller freight forwarders are struggling for margins and the bigger players are moving towards consolidation in Europe.

The geopolitical tensions coupled with the port strikes posed major headwinds for the shipping industry in Europe. But the overall industry is bullish about the market and hopes for recovery.

Average container prices bottoming out

With our platform data, we do observe that the container prices are not falling at a staggering rate, and these seem to be rather resilient in Europe over the past 30 days.

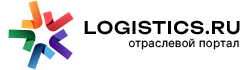

The average prices in Europe for cargo worthy 20 ft dry containers has continued to decline month on month until April. These prices are significantly lower than those in Shanghai and in Los Angeles. (See chart below). The average price for a cargo worthy 20 ft DC is anywhere between $750 to $1700

GRAPH 1: Average prices for 20 ft dry containers (6-month comparison) Ports of Antwerp, Hamburg, Rotterdam and Los Angeles and Shanghai

Bloated CAx levels finally cooling off

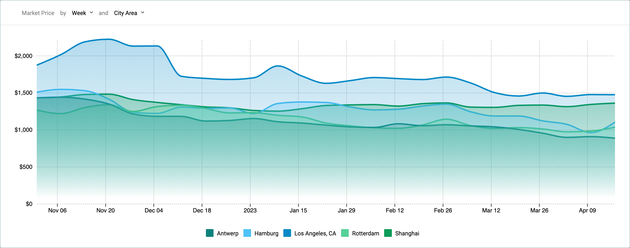

Container xChange reported in March 2023 that there is a situation of excess of containers in Europe. But the situation seems to have improved since last month.

Looking at how container availability has improved, we infer from our data that the Container availability index (CAx) has improved significantly if we compare to the past two years. The elevated CAx values are now coming down which indicates a better balance of inbound to outbound containers.

GRAPH 2: Antwerp CAx chart for 20 ft dry containers

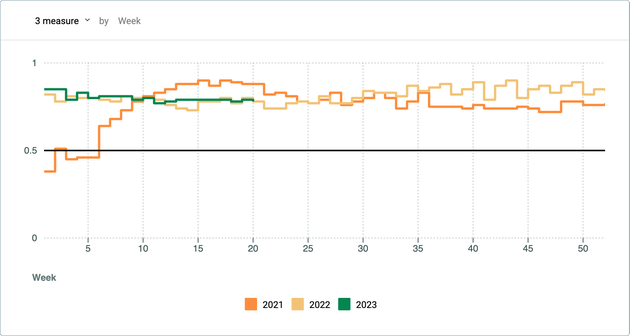

In Hamburg, we see bloated CAx figures, but if we compare those year on year, then there seems to be an improvement in the inbound to outbound containers ratio.

GRAPH 3: Hamburg CAx chart for 40 ft High cube container

The Road Ahead

While the overall economic outlook for Europe brings signs of rebound, the container logistics industry in general is grappling with many struggles like depots being overwhelmed, rates bottoming out, the global bank crisis, and overshooting demurrage and detention costs. Companies are struggling to find their feet on the ground, and it will still take a few months before the demand recovers. Till then, the industry players are focusing on improving their margins and sustaining their business.

Container xChange is an online container logistics company that provides a neutral infrastructure and operating system for container trading, container leasing and container management.