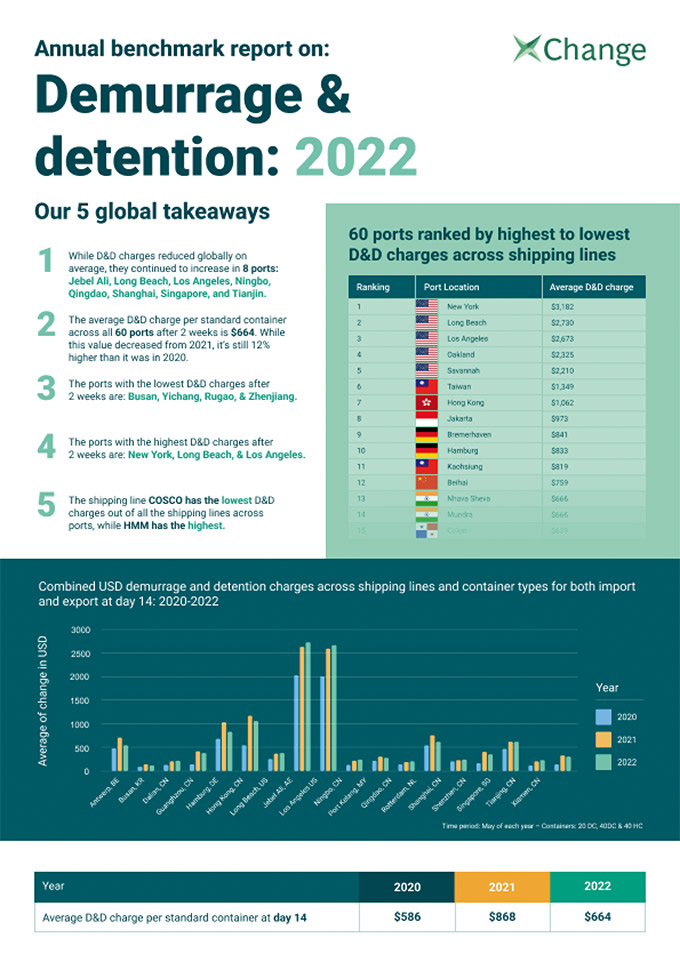

Demurrage and Detention (D&D) charges imposed on the US shippers by container lines continue to be the most expensive in the world and have increased this year even as global average fees have fallen from the record highs of 2021, according to Container xChange, the world’s leading online platform for the leasing and trading of shipping containers.

Container xChange’s Demurrage & Detention Benchmark 2022 report, published today, ranks the most expensive global ports for D&D charges (see definitions below) levied by container lines on customers two weeks after a cargo arrives at the port or is discharged from the vessel.

Even as U.S. regulators have taken a keen interest in container line behaviour amid soaring U.S. inflation and historically high shipping costs, U.S. ports occupy the top five spots in Container xChange’s rank list of “60 ports ranked by highest to lowest D&D charges across shipping lines”.

New York leads the way in 1st place followed by the ports of Long Beach, Los Angeles, Oakland and Savannah. All five ports are more than 2-3 times more expensive than Hong Kong in 7th spot and at least 20 times more expensive than leading Asian container hubs such as Dalian in China and Busan in Korea.

Political spotlight on D&D

Under heavy pressure from shipper lobbyists, President Biden signed the Ocean Shipping Reform Act into law on June 16, 2022. OSRA gives the Federal Maritime Commission the power to act more assertively on D&D charges and shifts the burden of proof for the reasonableness of fees to ocean carriers instead of shippers.

“Throughout this pandemic as shipping costs have soared and inflation has become a threat to the U.S. economy, the focus on container line behaviour by politicians and regulators has magnified,” said Christian Roeloffs, co-founder of Container xChange.

“U.S. agricultural shippers have been particularly outspoken about their inability to find affordable empty containers for exports. But importers have been equally outraged by what many believe has been profiteering on D&D charges by container lines. Some have started legal actions against carriers.

“This really came into the cross hairs of President Joe Biden this year when he has been highly critical of container lines. His administration addressed D&D in the Ocean Shipping Reform Act and we’re now waiting to see how this will be implemented and whether it will change shipper or carrier behaviour significantly.”

Global average D&Ds fall; US hubs see rises

Container xChange’s Demurrage & Detention Benchmark 2022 report notes that global average D&D charges levied by container lines on customers two weeks after a cargo was discharged from the vessel increased by 38% for standard-sized containers from $586 in 2020 to $868 in 2021.

So far in 2022, average D&D charges by major ports have declined to an average of $664 per container by 26%, although fees remain far higher than pre-pandemic at around 12%.

Even so, the U.S. shippers are not benefitting from these global declines in D&D charges. For example, in May 2022 the average charges levied by container lines on customers two weeks after a box was discharged from the vessel at the port of Long Beach was $2730 per container, up from $2638 a year earlier. At the port of Los Angeles in May 2022, the average D&D fees increased from $2594 per container in 2021 to $2672 per container.

Fees vary by port and carrier

Container xChange’s Demurrage & Detention Benchmark 2022 report also notes that D&D charges vary widely by port and by the carrier.

Of the leading container lines across ports, COSCO currently has the lowest D&D charges while HMM’s D&D fees are the highest.

By region, D&D charges in May in the US were the highest at £2,692 per container. This compared to $549 in Europe, $482 in India, $453 in China and $366 in the ‘Rest of Asia’.

Container xChange’s Demurrage & Detention Benchmark 2022 report also outlines how choosing the right carrier for a specific port can significantly impact D&D costs.

For example, notes the report, at Rotterdam in mid-year, average D&D charges at the end of the two-week period were $564 per container. However, shipping with ONE cost $809 container “which, when compared to the port’s average D&D charges, will escalate your container shipping costs by 43%”.

Methodology

To compile the report, Container xChange collected more than 20,000 data points from publicly available sources. These were used to compare D&D rates imposed on customers by the world’s eighth-largest shipping lines across 60 container ports in the world. The data was then compared against data collected by Container xChange mid-year 2021 and 2020.

Commenting on Container xChange’s Demurrage & Detention Benchmark 2022 report, David Lademan, Associate Editor of the Container Markets division at S&P Global Commodity Insights, said, "The issue of demurrage and detention as a part of the overall cost of freight has been brought to the fore because of the market imbalances that we have seen over the past two years.

Many shippers have reported that demurrage charges have been levied against them despite cargo being buried under stacks of containers at logjammed ports, which leaves them functionally unable to retrieve their containers.

On the other hand, cargo owners have altered their behaviour with inland moves, as detention fees have grown in value and frequency, with many ocean carriers stripping free time in a bid to keep container velocity elevated. Many shippers are now in the practice of cross-docking cargos, to return containers quickly and avoid elevated fees. This comes amid an already protracted period of turbulent market conditions.”

Cutting D&D costs

Dr Johannes Schlingmeier, CEO & Founder of Container xChange, said using shipper-owned containers (SOCs) instead of shipping line/carrier-owned containers (COCs) could help reduce shipper supply chain costs.

“Taking the SOC options means you're not leasing a container from the shipping line,” he said. “So, if your container gets held up inside or outside of the terminal, you won't have to pay late fees to them.

“More generally, I think we need common sense to prevail on D&D fees rather than regulatory intervention. Better planning by all supply chain partners and better communication between logistics partners and stakeholders can help reduce liability and exposure.”