Analysis from Christian Roeloffs, cofounder & CEO of Container xChange

Key Highlights from the analysis

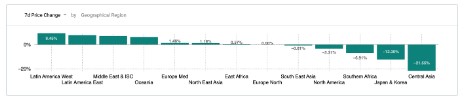

“Some of the main ports in Germany like Rotterdam, Hamburg, Bremen are posting significant week on week price increases and of course the interpretation is that the situation in the Red Sea has contributed to this increase.”

“The market anticipates that especially in Europe which is on the receiving end of import containers from the Middle East, India, southeast Asia and China, that container scarcity will lead to an increase in container prices and the market.” Explained Christian as part of the analysis.

7-days price change of container prices

“Ports at the receiving end of those import containers like the port of Rotterdam and Hamburg, are recording a significant increase in container prices over the last two weeks, since the situation in Red Sea started to escalate.”

“A consistent pricing trend is observed in the surge of Freight rates. Xeneta’s reports indicate a spot rate increase of 20 to 30% on major East-West corridors.”

“The key question for the industry is the duration of the current situation. Is it a temporary disturbance, a perceived bump in the road, or are carriers capitalizing on the situation as container vessels are diverted around the southern tip of Africa, adding strain due to the Suez Canal’s inaccessibility.”

Approximately 1.4 to 1.77 million TEU of capacity, accounting for 5 to 6% of the market’s total capacity, is affected. This offers relief for carriers amid the current state of overcapacity.

“The lingering question is the duration of this circumstance and when naval forces, particularly from Egypt, Great Britain, France, and the US, will take control of security in the Red Sea.”

“Industry sources suggest that this task might not be straightforward. Forming convoys could impede traffic, and addressing drone boat attacks poses challenges, especially considering the difficulty of detecting these boats in high-traffic areas like the Red Sea.”

Container xChange